Yibai Insights

Explore the latest trends, news, and insights from around the world.

Savings on Wheels: Uncovering Hidden Auto Insurance Discounts

Unlock hidden auto insurance discounts and save big! Discover the secrets to cutting your car insurance costs today!

10 Lesser-Known Auto Insurance Discounts You Might Be Missing

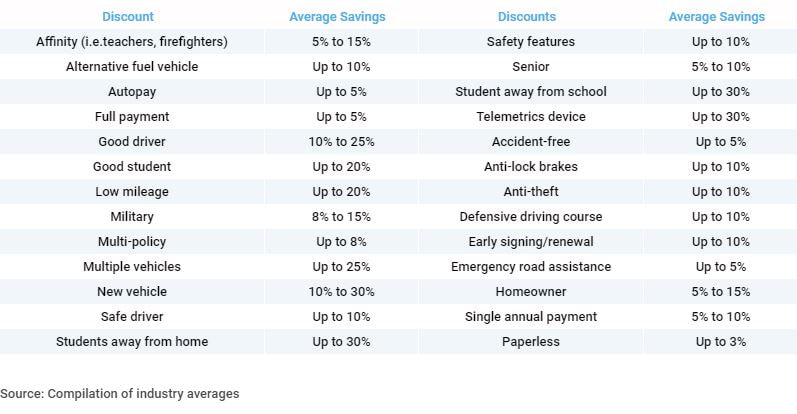

When it comes to auto insurance, most people are aware of the common discounts like safe driver bonuses and multi-policy savings. However, many lesser-known auto insurance discounts can significantly lower your premium without sacrificing coverage. For instance, did you know that some insurance companies offer discounts for completing a defensive driving course? These courses not only enhance your driving skills but can also lead to substantial savings. Additionally, if your car is equipped with certain safety features such as anti-lock brakes or advanced airbag systems, you may qualify for additional discounted rates.

Another hidden gem in the world of auto insurance discounts comes from vehicle mileage. If you have a low annual mileage, some insurers reward you with lower premiums because less time on the road means a decreased risk of accidents. Similarly, members of certain professional organizations or alumni groups can access exclusive discounts. Remember, it’s essential to ask your insurer about these options, as they may not be advertised prominently. By exploring these lesser-known discounts, you could find additional savings and ensure you’re getting the best value for your auto insurance policy.

Is Your Car Insurance Costing You Too Much? Discover Hidden Discounts!

Are you tired of paying hefty premiums for your car insurance? You might be surprised to learn that many drivers are overpaying without even realizing it. Insurance companies often provide hidden discounts that can significantly reduce your coverage costs. Whether it's for maintaining a good driving record, bundling policies, or completing a defensive driving course, these cost-saving opportunities are just waiting to be discovered. To help you uncover these savings, start by reviewing your current policy and asking your agent about potential discounts that may apply to your situation.

Another effective way to lower your car insurance costs is by taking advantage of loyalty discounts and membership affiliations. Many insurers offer reduced rates for long-term customers or members of certain organizations, such as professional associations or alumni groups. Additionally, consider adjusting your premium payment schedule. Opting for annual payments instead of monthly installments can lead to additional savings. By staying informed and proactive about your coverage, you can ensure that you’re not just adequately insured, but also optimizing your expenses toward a more affordable car insurance premium.

How to Maximize Your Savings: A Guide to Auto Insurance Discounts

Maximizing your savings on auto insurance can significantly lower your monthly expenses without sacrificing essential coverage. Many insurance providers offer a variety of discounts that can help you save money. To take full advantage of these savings opportunities, it’s important to understand the different types of discounts available. Common options include safe driver discounts, multi-policy discounts, and good student discounts. For example, if you maintain a clean driving record, some insurers may reward you with lower premiums. Additionally, bundling your auto insurance with home or renters insurance could unlock substantial savings.

Moreover, you should actively inquire about discounts that may not be widely advertised. Consider asking your insurance agent about pay-as-you-drive programs, which can offer lower rates based on your driving habits. Also, check if you qualify for affinity group discounts if you belong to certain organizations or alumni associations. Here are a few more ways to maximize your savings:

- Increase your deductible. Higher deductibles usually lower your premiums.

- Review your coverage. Ensure you're not paying for unnecessary extras.

- Stay loyal. Some insurers provide loyalty discounts for long-term customers.