Yibai Insights

Explore the latest trends, news, and insights from around the world.

Cash in on Auto Insurance Perks

Unlock hidden savings and exclusive benefits with auto insurance perks! Discover how to maximize your coverage today!

Maximizing Your Savings: A Guide to Auto Insurance Perks

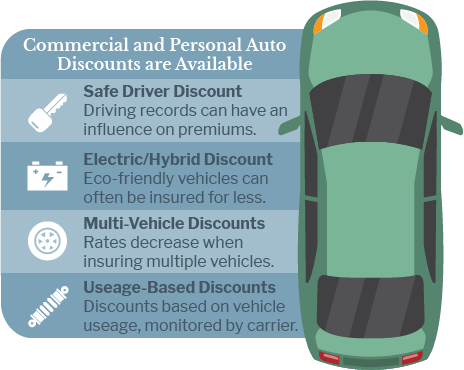

When it comes to maximizing your savings, understanding the various perks offered by your auto insurance policy can make a significant difference. Many insurance providers offer discounts for safe driving records, bundling policies, or even having certain safety features in your car. Examples of these features include anti-lock brakes, airbags, and advanced driver-assistance systems. By taking advantage of these perks, you can not only protect your vehicle better but also reduce your premium costs.

Additionally, it's essential to review your policy regularly and ask your insurer about any new or seasonal discounts that may apply. Some companies offer loyalty rewards for long-term customers or discounts for completing defensive driving courses. Keep an eye out for promotions or programs that encourage good driving habits, as they can provide substantial savings over time. By actively seeking out and utilizing these auto insurance perks, you can enhance your overall savings and ensure you're getting the best value for your coverage.

Top 5 Benefits of Leveraging Your Auto Insurance Policy

Leveraging your auto insurance policy can provide numerous advantages that extend beyond basic coverage. By understanding and utilizing the full range of benefits, policyholders can enhance their financial security and peace of mind. One significant benefit is financial protection; in the event of an accident, your policy can cover not only damages to your vehicle but also liability costs associated with injuries to other parties. Additionally, many policies offer roadside assistance, ensuring that help is just a call away when you encounter vehicle troubles.

Another crucial advantage of leveraging your auto insurance policy is the potential for savings on premiums. Many insurers provide discounts for safe driving records, multiple policies, or even for certain safety features in your car. Furthermore, policyholders can take advantage of policy add-ons such as rental car coverage, which can save you out-of-pocket expenses if your vehicle is in the shop. By fully utilizing these benefits, you can maximize the value of your auto insurance and ensure that you are prepared for the unexpected.

Are You Missing Out on Hidden Auto Insurance Discounts?

Many drivers are unaware that they may be missing out on hidden auto insurance discounts that could significantly reduce their premiums. Insurance companies offer a variety of discounts that go beyond the standard safe driving or multi-policy discounts. For instance, you might qualify for a low mileage discount if you don't drive frequently or a good student discount if you're a young driver maintaining a high GPA. It's crucial to ask your insurance provider about any available discounts that fit your situation, as these can add up to substantial savings.

In addition to the more common discounts, consider exploring niche opportunities such as affinity group discounts, which are offered to members of certain organizations or professions. Some insurers also provide discounts for installing safety features in your car, like anti-theft devices or advanced driver-assistance systems. Don't hesitate to shop around and compare different companies; you might find that another insurer offers even more valuable discounts tailored to your needs. By being proactive and informed, you can ensure you are maximizing your savings and not missing out on hidden auto insurance discounts that could benefit you.