Yibai Insights

Explore the latest trends, news, and insights from around the world.

Why Your Auto Insurance Bill Deserves a Makeover

Transform your auto insurance bill! Discover smart tips to save money and maximize your coverage in our latest blog post.

Top 5 Reasons Your Auto Insurance Bill is Overinflated

Understanding why your auto insurance bill is overinflated can save you money and improve your coverage. Here are the top 5 reasons that may contribute to higher premiums:

- Inaccurate Information: Sometimes, incorrect details like your driving history, vehicle type, or address can cause your rates to soar. Ensure that all your information is accurate and up-to-date.

- High Coverage Levels: While it’s important to be adequately covered, opting for higher limits and additional coverage can significantly increase your bill. Regularly review your policy to ensure it meets your current needs without unnecessary extras.

Continuing with the reasons, here are three additional factors that could be inflating your auto insurance costs:

- Credit Score Impact: Many insurers consider your credit history when determining premiums. A lower credit score may lead to higher rates, so maintaining good credit can save you money.

- Frequent Claims: If you've filed multiple claims in a short period, insurers may view you as a higher risk, resulting in elevated premiums. It's crucial to weigh the necessity of a claim versus the potential impact on your rates.

- Location, Location, Location: Living in an area with high crime rates or heavy traffic can also drive up your insurance costs. If you're contemplating a move, consider how it may affect your auto insurance bills.

How to Revamp Your Auto Insurance Policy for Maximum Savings

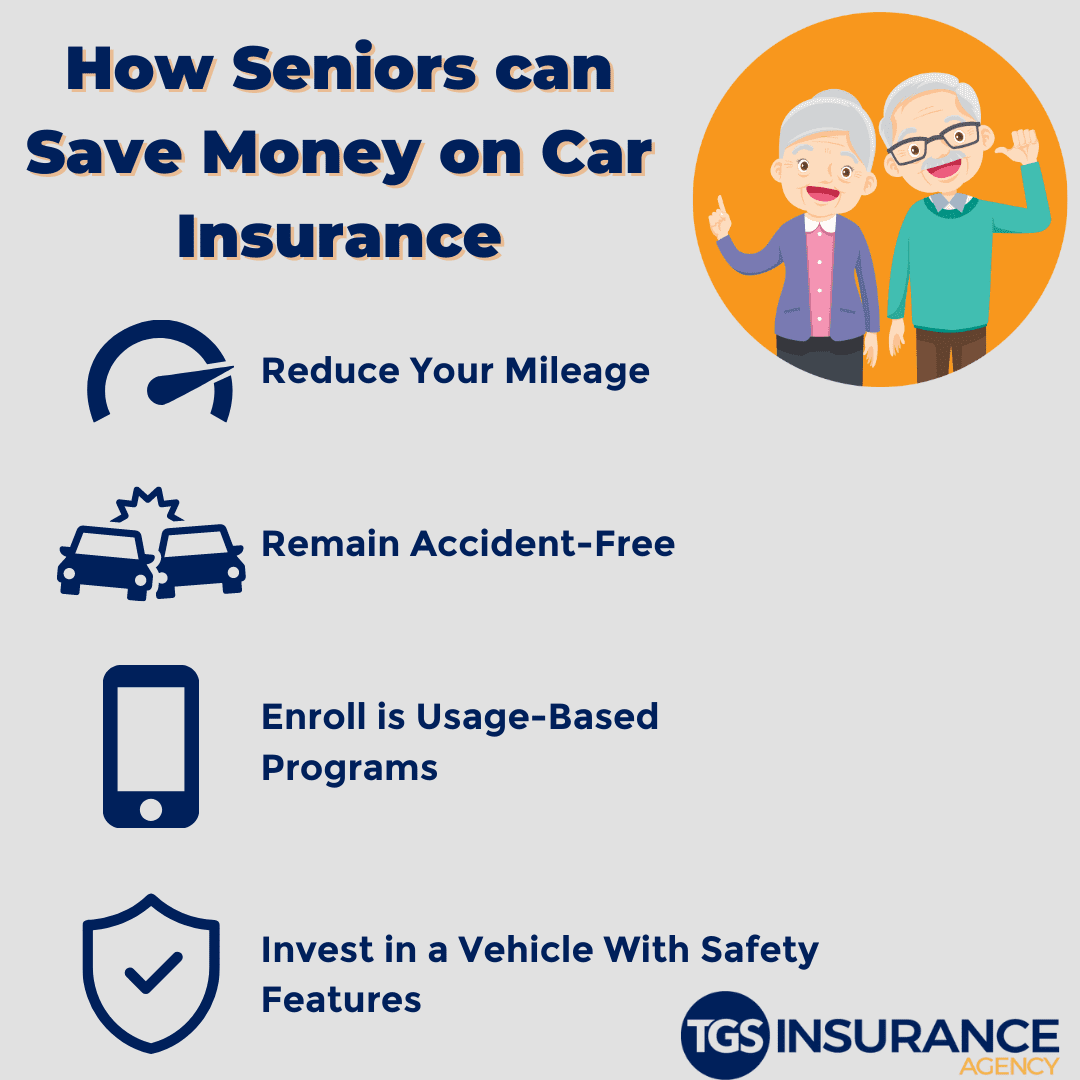

Revamping your auto insurance policy is crucial for maximizing savings without sacrificing coverage. Start by reviewing your current policy and identify areas where you can cut costs. Consider increasing your deductible, which can reduce your premium significantly. Additionally, take advantage of discounts offered by insurance providers, such as bundling your auto insurance with other policies, maintaining a good driving record, or enrolling in safe driving courses. Regularly comparing quotes from different insurers can also reveal potential savings and ensure you are getting the best deal available.

Another effective way to revamp your auto insurance policy is by regularly updating your coverage based on your changing needs. For instance, if you’ve paid off your car, you might want to drop collision or comprehensive coverage. Furthermore, explore options like usage-based insurance, which offers premiums based on your driving behavior, making it an attractive choice for safe drivers. By staying informed and proactive about your policy adjustments, you can achieve maximum savings while maintaining adequate coverage for your vehicle.

Is Your Auto Insurance Coverage Working for You?

When it comes to auto insurance, it's essential to ensure that your policy is working for you. This means evaluating not only the coverage you have but also understanding what it includes. Many drivers settle for the minimum required coverage, unaware that it may not adequately protect them in the event of an accident. To ensure your auto insurance is effective, consider reviewing the following key aspects:

- Liability coverage limits

- Comprehensive and collision coverage options

- Deductible amounts

- Personal injury protection

It's also wise to reassess your auto insurance policy periodically, especially after major life changes like purchasing a new vehicle or moving to a different location. Additionally, discounts for safe driving records, multiple policies, or good student status can significantly reduce your premiums while still providing robust protection. Remember, effective auto insurance coverage is not just about meeting legal requirements; it's about ensuring peace of mind on the road. Regularly asking yourself, Is my auto insurance coverage truly working for me?, can prompt valuable adjustments that enhance your financial security.